“Balance to Income” (BTI) - How It Impacts You

Borrowing Limit for Unsecured Credit

The Monetary Authority of Singapore (MAS) has placed a limit on the amount of unsecured credit that may be granted to borrowers.

The rule was implemented to help borrowers avoid accumulating excessive debt by enhancing the lending practices of Financial Institutions (FIs).

Known as Balance-to-Income (BTI) ratio, it is calculated by dividing the borrower’s outstanding interest-bearing unsecured debt by monthly income.

A lower BTI ratio demonstrates a good balance between debt and income. This would mean that the borrowers are likely to effectively manage their monthly obligations.

Likewise, a high BTI ratio can indicate that an individual has too much debt for the amount of income earned each month, this would suggest that the borrower might be struggling to pay off the debt payments relative to their income.

In addition, FIs may not grant further unsecured credit to an individual whose BTI ratio exceeds the industry-wide borrowing limit for three consecutive months.

The borrowing limit took effect on 1 June 2015, starting with a BTI limit of 24 times.

As from 1 June 2019, the prevailing BTI is 12 times of monthly income.

What’s my BTI?

BTI can be calculated using this simple formula:

Total Unsecured Interest-Bearing Balances across all Financial Institutions

divided by

Monthly Income

If you are unsure of your total unsecured interest-bearing balances, you can purchase a copy of your credit report from Credit Bureau (Singapore).

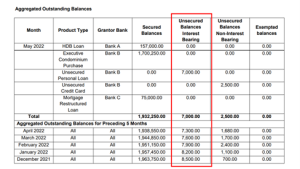

You may find the required information under “Aggregated Outstanding Balances” like the example boxed in red below:

View of sample report obtained from https://www.creditbureau.com.sg/pdf/Enhanced-Consumer-Credit-Report-2022.pdf

How does it impact me?

If the total interest-bearing outstanding balances on all credit cards and unsecured credit facilities with all FI in Singapore exceed the industry-wide borrowing limit for 3 consecutive months, your account will be suspended and you will not be able to:

- Charge new amounts to your existing credit card(s) and/or use other unsecured credit facilities with all financial institutions;

- Obtain credit limit increases on your existing credit card(s) and/or other unsecured credit facilities with all financial institutions;

- Apply new credit cards or other unsecured credit facilities from all financial institutions.

- This means that the FI cannot allow further drawdown of existing credit limits, approve credit limit increases, or grant new credit facilities to such a borrower.

If your unsecured outstanding balances with any financial institution are more than 60 days past due, you will not be able to:

- Charge new amounts to your existing credit cards and/or other unsecured credit facilities with that same financial institution;

- Obtain credit limit increases on your existing credit cards and/or other unsecured credit facilities with all financial institutions; and

- Obtain new credit cards or other unsecured credit facilities from any financial institution. This is to prevent debt from spiralling for a borrower who has problems making

However, this BTI rule does not apply to the following:

- Unsecured loans for needs-based purposes (e.g. business, medical and education);

- Borrowers with annual income of $120,000 or more; and

- Borrowers with net personal assets exceeding $2 million.

Borrow responsibly

Borrowing beyond your means can leave you struggling financially as you go further into debt. Consider all the other existing loans that you have and understand your financial standing before applying for additional loans. Do not borrow for the sake of repaying another debt as you may risk falling into multiple, bigger debts which makes it even more difficult for you to repay in the future. It is also important to do ample research and clear any doubts with the lenders before you agree to take up any new credit/loan facilities.

Where can I get a copy of my credit report?

To check your credit score, you can purchase a copy of your credit report from Credit Bureau Singapore.

For a detailed explanation of a credit report, you can view a sample credit report with explanatory notes here.

Be sure to like and follow Credit Bureau Singapore on Facebook and LinkedIn for more useful content and tips to maintain a good credit reputation!

If you are facing increasing difficulties servicing payments to your credit cards or other unsecured credit facilities, consider attending our weekly Debt Management talks (conducted both over Zoom and in-person at our office), where you will learn more about what to do, when and how to communicate with creditors, what are the common collection actions creditors can take, what are the various debt settlement options are and what is the CCS Debt Management Programme. Click here for schedule.

After attending the talk, you can submit a request for one-to-one credit counselling. Details on the counselling session and instructions on how to arrange for an appointment will be explained during the talk.

Contributed by Credit Bureau Singapore

Published 28 October 2022.